NIKE Inc.: Current Valuation Will Take Some Time For Growth To Catch Up

Summary

- At its current price levels, investment in NIKE Inc. represents a high quality business that is substantially overvalued.

- This article focuses on two of the most important aspects of a sustainable business: profitability as measured by ROCE and capital allocation flexibility.

- The results shed insights into potential returns both in the short term and long term.

- It is no doubt a high-quality investment; however, investment at this point will take some time, patience, and commitment for the fundamentals to catch up.

Thesis and Background

At its current price levels, investment in NIKE, Inc. (NKE) represents a high quality business that is substantially overvalued. This article focuses on two of the most important aspects of a sustainable business: profitability as measured by ROCE and capital allocation flexibility.

The results shed insights into potential returns both in the short term and long term. The upside in the short term is limited in both directions. Sneakers2090 ,But in the long term, it is no doubt a high-quality investment given its high ROCE and financial flexibility. However, investment at this point will take some time, patience, and commitment for the fundamentals to catch up.

ROCE and Profitability

Let’s first look at one of the most important metric for a sustainable business: profitability as measured by ROCE and capital allocation effectiveness. ROCE stands for the return on capital employed. And note ROCE is different from the return on equity (“ROE”), and is way more fundamental and important in my view. ROCE considers the return of capital ACTUALLY employed, and therefore provides insight into how much additional capital a business needs to invest in order to earn a given extra amount of income – offering key insights into profitability, capital requirements, and growth rate.

With this understanding, let’s look at NKE’s ROCE more closely. For a business like NKE, I consider the following items invested capital:

1. Working capital, including payables, receivables, inventory. These are the capitals required for the daily operation of the businesses.

2. Gross Property, Plant, and Equipment. These are the capitals required to actually manufacture and sell the products.

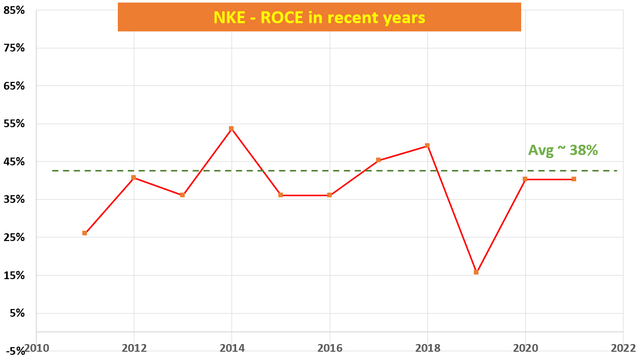

Based on the above considerations, the ROCE of Latest Jordan UK over the past decade are shown below. As seen, NKE was able to maintain a consistently high ROCE over the past decade: on average 38% for the past decade and quite consistent as seen.

Source: Author and Seeking Alpha data.

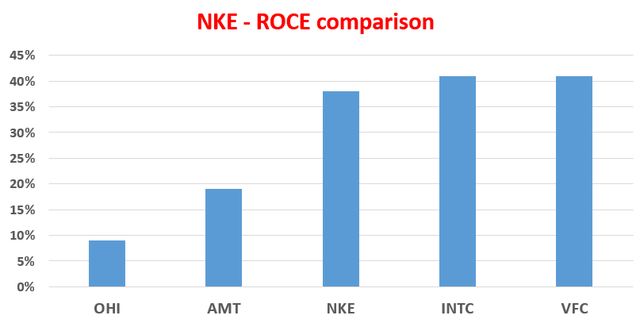

To help put things under perspective, the next chart shows the ROCE of a few other stocks (OHI, AMT, INTC, VFC) that I’ve analyzed recently. The ROCE data are directly pulled from my previous analyses. In case you want to see the details of how I got these numbers, you can look up my recent articles under these tickers. The purpose here is certainly not to compare oranges with apples. The purpose here is to put NKE’s ROCE into perspective. As can be seen, despite the random nature of this collection of businesses, they are all good quality and mature businesses. And NKE earns a respectable ROCE that compares favorably among them.

Source: Author and Seeking Alpha data.

Valuation metrics and short term returns

After confirming its profitability sustainability, let’s look at the valuation. As can be seen from the following numbers in the table, at its current price levels, NKE is substantially overvalued by about 30~40% depending on which valuation metric you use based on its historical valuations. 2021 Yeezy Boost In terms of absolute valuation, its current valuations (FW PE around 39x and price/cash flow ratio around 35x) is not only at the high end of its own historical record, but also at the high end of most of the mature large caps.

Source: Author and Seeking Alpha

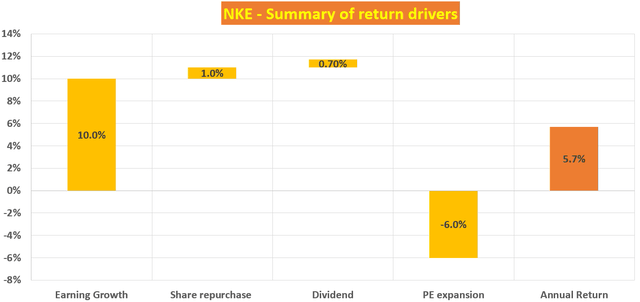

Based on the above analysis of the business fundamental, growth potential, and valuation metrics, it is relatively straightforward to project the return in the next few years. Here let’s consider the following “normal” scenario. This scenario considers the following return drivers:

1. 10% growth in total profit – on the conservative side of consensus forecasts.

2. 1% share repurchases, consistent with its recent year level.

3. Dividend on the current 0.7% level (assuming dividend increase would keep the dividend yield approximately at the current level).

4. A valuation fluctuation around the mean due to market mood swings. If this occurs, it will cause about -6% CAGR in the next 3~5 years.

Based on the above return drivers, the annual return should be around 6% a year as shown below, with a total return of about 20% in the next 3~5 years.

Source: author

Long-term return and perpetual growth rate

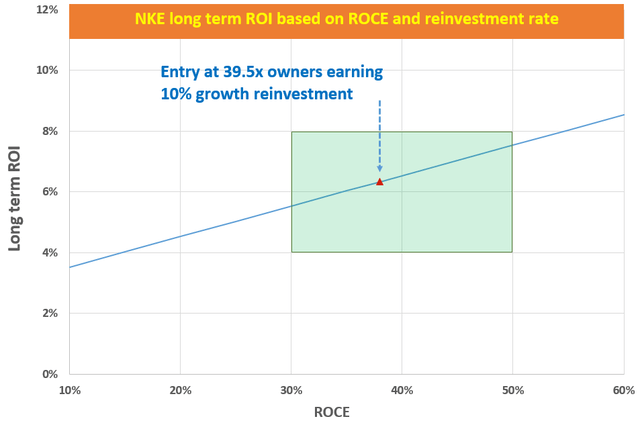

If you, like this author, are a long-term investor who subscribes to the concepts of owner earnings, perpetual growth rate, and equity bond, then the long-term return is simpler.New Air Force 1 , It is “simply” the summation of the owner earnings yield (“OEY”) and the perpetual growth rate (“PGR”), i.e.,

Longer-Term ROI = OEY + PGR

Because in the long term, all fluctuations in valuation are averaged out (all luck at the end even out). And it doesn’t really matter how the business uses the earnings (pay out as dividend, retained in the bank account, or repurchase stocks). As long as used sensibly (as NKE has done in the past), it will be reflected as a return to the business owner.

OEY is the owner earnings divided by the entry price. All the complications are in the estimation of the owner earnings – the real economic earnings of the business, not the nominal accounting earning. Here as a crude and conservative estimate, I will just use the free cash flow (“FCF”) as the owner earnings. It is conservative in the sense that rigorously speaking, the owner earnings should be free cash flow plus the portion of CAPEx that is used to fuel the growth (i.e., the growth CAPEx). At its current price levels, the OEY is ~2.5% for NKE (~39.5x price to FCF – again, quite expensive valuation).

The next and more important item is the PGR. In the long term (like 10 years or more), the growth rate is simply:

Longer-Term Growth Rate = ROCE * Reinvestment Rate

This is part of the reason why ROCE is such a fundamentally important metric for business sustainability. It directly provides insight into how much additional capital a business needs to reinvest from its earnings in order to earn a given extra amount of income. Since we’ve already obtained ROCE, we now just need to figure out the reinvestment part.

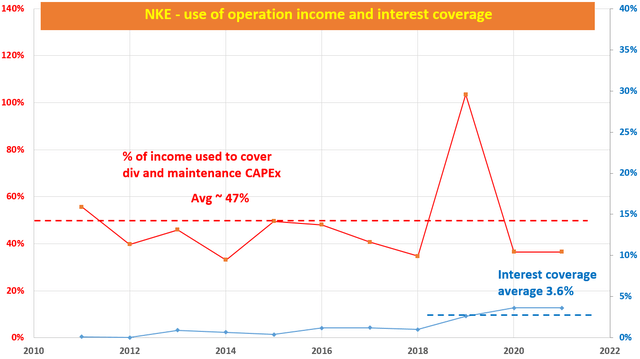

The following chart shows how NKE has been allocating its income in the past decade. As can be seen, first, the business is effectively debt free. The interest payment is a negligible part of earnings (about 3.6%). Second, dividend and maintenance CAPEx have been the major items, costing on average 47% of operation cash (“OPC”). Neither cost is optional. Jordan 2020 Release ,For a dividend stock like NKE, the dividend is not really optional – it probably will be the last cost that management is willing to cut. Maintenance CAPEx is simply what it takes to keep the business running.

For the remaining 53%, the company does have a choice. It can use it for a variety of things: reinvest to fuel further growth, pay an extra special dividend, pay down debt, buy back shares, et al. It obviously makes total sense to reinvest all of it to fuel further growth given its high ROCE. But the problem is that for businesses at this scale, there are just not that many opportunities to reinvest the earnings. As a result, NKE has been allocating almost all the remaining earnings to buy back shares.

Source: Author and Seeking Alpha.

With a 38% ROCE and 10% reinvestment rate, it means that even if NKE only reinvests 1/10 of its earnings to expand the capital employed, it could maintain a 3.8% PGR (PGR = ROCE * fraction of earnings reinvested = 38% * 10% = 3.8%). And 10% reinvestment rate is indeed the situation here for NKE based on my analyses. As aforementioned, this is part of the reason that NKE can afford to use all the remaining income on share repurchase. It does not need that much reinvestment to grow. Of course, another reason is that businesses at this scale simply are not able to find that many opportunities to reinvest their earnings. But after all, 3.8% PGR already makes it a long term compounder with 10% income reinvested.

Now we have both pieces of the puzzle in place to estimate the long-term return. At its current price levels, the OEY is estimated to be ~2.5% for 2020 Air Jordans, and the PGR is about 3.8%. So the total return in the long term at current valuation would be an upper single digit around 6.3% as shown the chart below. Also as seen, even when ROCE fluctuates somewhat, the fluctuations wouldn’t change the long-term return dramatically.

Source: Author and Seeking Alpha.

Conclusion and final thoughts

At its current price levels, NKE represents a high quality business that is currently substantially overvalued. This article examined two of the most important aspects of a sustainable business: profitability as measured by ROCE and capital allocation flexibility.

The results first and foremost show that NKE consistently earns ROCE that is not only high but also very consistent – both hallmarks of a good quality business with a stable moat. The ROIC has been on average about 38% in recent years, and compares very favorably against other good quality and mature businesses.

Investment at this point will have limited return potentials in the near term due to its current valuation. However, there is not too much downside risks either given its quality, financial flexibility, and consistent profitability.

In the long term, with a ROCE of ~38% and the strong cash generation ability, the business could sustainably support a mid single-digit growth rate organically, and the business has plenty of space to increase leverage to fuel further growth if needed. At this point, investment will take some time, patience, and commitment for the fundamentals to catch up.