Nike Stock Forecast: Can It Hit $200? What To Consider

Summary

- Nike’s stock price has significantly outperformed its peers and the broader markets over the last 18 months.

- While the company’s forward P/E multiple appears higher versus its historical average, it is supported by an acceleration in growth.

- I believe the stock can trade north of $200 in the medium term.

Nike Inc.’s (NKE) stock price has seen a good run-up in the last 18 months and the stock is now trading more than 60% higher compared to its pre-Covid levels. The company’s performance during this time period has been much better than its peers Adidas (OTCQX:ADDYY) and Skechers (SKX) as well as the broader S&P 500 (SPY). The roots of the company’s recent outperformance can be traced back to fiscal 2018 when the company began implementing its Consumer Direct Offence and Triple Double Strategy. At its investor’s day in October 2017, the company revealed this strategy to further strengthen its leadership position and derive long-term, sustainable and profitable growth.

With Consumer Direct Offense and Triple Double strategy, the company intended to serve its consumer faster and more personally at scale. Air Jordan Sneakers ,The Triple Double strategy consisted of adding resources in three core areas of the business – innovation, speed, and direct sales – to double their impact. For example, the company used to generate ~15% of its sales from digital platforms back in 2017. On its investor’s day that year, it provided a target to increase digital revenues to ~30% of the total sales by FY2022. The company was really well placed for digital transformation due to these efforts and when Covid-19 related shutdown hit the company and its competitors’ retail stores, it effortlessly pivoted to online sales and gained significant market share.

Buoyed by the success of its strategy, in June 2020, the company announced a new digitally empowered phase of the Consumer Direct Offense strategy: Consumer Direct Acceleration. This strategic acceleration will focus on three specific areas:

- Creating the marketplace of the future through more premium, consistent, and seamless consumer experiences that more closely align with what consumers want and need.

- Aligning product creation and category organizations around a new consumer construct focused on Men’s, Women’s and Kids’.

- Unify investments in data and analytics, demand sensing, insight gathering, inventory management, and other areas against an end-to-end technology foundation to accelerate the company’s digital transformation.

The company also recently provided an FY2025 outlook which includes high single-digit to low double-digit revenue growth; gross margins in the high 40s; 2021Sneakers ,EBIT Margin in the high teens; and mid to high teens diluted earnings per share growth. This indicates management’s confidence that Nike has a significant runway of growth going forward.

Will Nike stock go up?

Nike is currently trading at ~$167. It has seen a great deal of volatility over the last 18 months. The stock was trading over $100 before Covid-19 stuck and it corrected to the low 60s in March 2020. However, it recovered completely by June 2020 and continued to move higher as the company was able to take advantage of its strong digital presence to gain market share. The digital trend still remains strong. On its last earnings call, management noted that even as physical retail reopened, they continue to see strong growth in NIKE Digital with revenues up ~37% YoY in Q4. The trends were even stronger in North America with NIKE Digital sales up ~50% YoY in this geography. The company’s digital initiatives are leading to increased membership and a deeper consumer connection which is proving to be a compelling driver of repeat engagement and buying across digital and physical retail platforms.New Drop Jordans, This is getting reflected in the increased average order value and buying frequency. The company now has more than 300 million NIKE members, and more importantly, buying member growth is outpacing new member growth, signaling the increased engagement of the existing members.

In addition to strong digital growth, the company is expected to benefit from structural tailwinds like the return to sport and a permanent shift in consumer behavior toward health and wellness activities. The company’s women’s business (up 22% versus prior year) and Jordan Brand (up ~31% YoY) are also expected to drive strong momentum. So, Nike’s growth is likely to accelerate going forward.

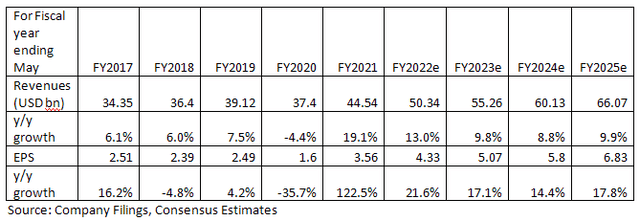

If one looks at Nike’s current valuation, it is trading at a forward P/E of ~38x which is much higher than its five-year average forward P/E of ~31.54x. However, the company’s growth rate has also accelerated versus what we have seen from FY2017 to FY2021. Over the last four fiscal years, the company has seen ~6.7% CAGR for revenues and ~9.1% CAGR for EPS. Sneakerheads2020 ,However, over the next four years, revenue growth is expected to accelerate to the high single-digit/ low double-digit range, while EPS growth is expected to be in the mid to high teens range.

So, one can justify the company’s higher valuations versus its historical range based on the acceleration in its revenues and earnings trend. The interesting thing is we are still in the initial phases of this acceleration and this high growth rate is expected to continue for the next several years as the company’s digital and other initiatives continue to take hold. So, I believe there are good chances that the stock will continue its upward trajectory. Its P/E multiple might not expand anymore but high EPS growth is likely to continue driving the stock upwards.

Can Nike stock hit $200?

If we take a medium-term three-year view, and assume that by the middle of the calendar year 2024 Nike’s forward P/E multiple will return to its 5-year average range of ~31.54x, we get a price target of $215 using the consensus EPS estimate of $6.83.

However, if you look at the consensus estimates, the revenue growth assumptions are at high single digits for FY2023, FY2024, and FY2025. New Air Force 1 ,The company has posted better than expected results in the recent past surpassing its previous investor day targets. So, I believe it is not unfair to assume that the company’s annual revenue growth in the FY2023 to FY2025 period can be in the low double-digit range which is the higher end of its guidance range. If we assume ~12% CAGR between FY2022 to FY2025, the FY2025 revenues will be north of ~$70 bn or ~6% better than consensus estimates. A similar improvement in EPS will give us EPS in the ~$7.25 range which gives a $228 target price using a 31.54x P/E multiple. [Note: The improvement in EPS should be higher because of operating leverage, but I am just being conservative here].

We may also argue that the company’s strong growth momentum will continue well beyond 2025 and the stock will continue to trade near ~38x forward P/E multiple it is currently getting. Using ~$7.25 in FY2025 EPS, we get a target price of ~$275 in this scenario.

So, there is a reasonable chance of the stock trading north of $200 if you have a medium-term view.

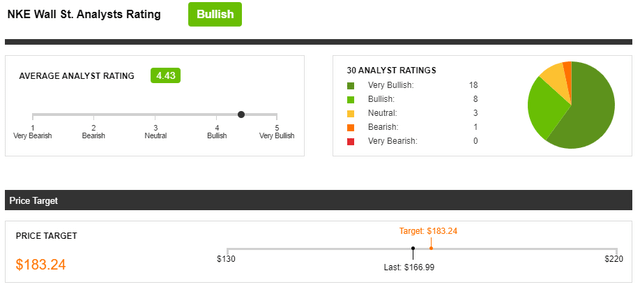

If we look at Wall Street ratings, sell-side analysts are mostly bullish on the company. The average target price for the stock is $183.24 with the lowest being $130 and the highest being $220.

I believe sell-side analysts take a relatively shorter-term view (1 year) while giving their price target which explains their range being lower than mine. 2021Shoes ,While the average target price and the highest target price for the stock can be justified, I don’t think there is a plausible scenario for the stock going back to the $130 price level which is the lower end of the street’s price target range.

Is NKE stock a buy or sell?

Despite its recent outperformance, I believe Nike is a good buy for long-term investors. If the company is able to achieve even the mid-point of revenue and EPS target it has given, the stock can trade at ~$215 in the next three years which implies ~30% upside. If the company does better and achieves the higher end of its guidance range and the momentum continues beyond 2025, we can see it trading at much higher levels.

Usually, when a company is executing well and has a leadership position in its industry, it generates more cash from its operations than its peers. Cadysneaker ,It can use that cash to invest back in its business to drive growth, innovation and better serve its customers which makes it more difficult for its competitors to catch up. This virtuous cycle a company using more cash to improve its offerings, and improved offering resulting in higher sales and more operating cash flow gives the company a very strong strategic advantage. I believe Nike has this advantage which will result in continued market share gains and higher than the industry growth rate. This is a very attractive set up for long-term investors. Hence, I believe the stock is a good buy at the current levels.