NIKE’s Position Remains Well-Entrenched

Investment Thesis

We positively view NIKE (NYSE:NKE) because we believe that NIKE will continue its dominance in the market. Through NIKE’s financial outlook, the management expressed its optimism towards the company’s long-term growth. First, 2021Sneakers has spread its presence in the European market through football and basketball. Second, the short-term headwind stemming from the Xinjiang cotton issue has subsided, leading consumers to flock to Western brands. Third, the factory closure in Vietnam is likely to be short-lived, like the West Coast port congestion that hampered supplies back in 2015. All in all, we believe that NIKE still has an upside despite trading at a premium.

Learning From The Past

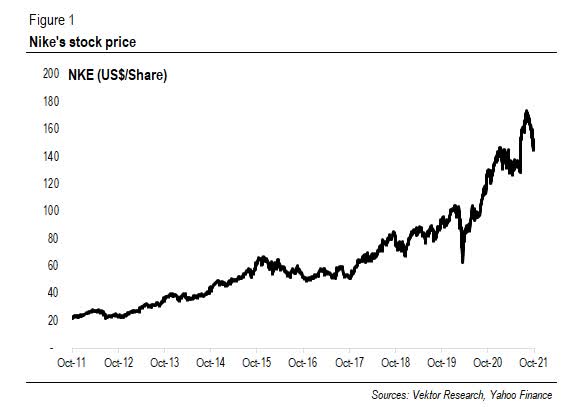

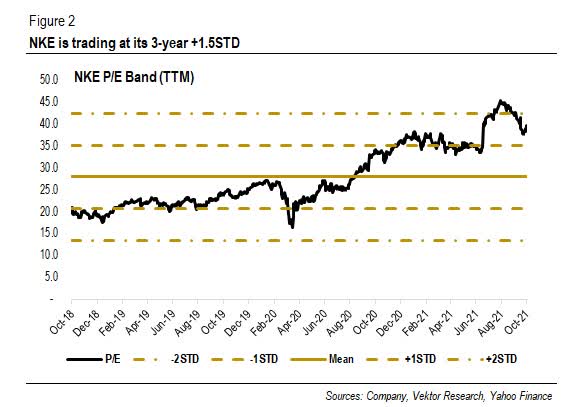

Being a fast-growing company, NIKE has become one of the investors’ favorite stocks. If you had bought NIKE at US$22/share ten years ago, the value would have grown by almost 600% (per October 8th). However, if we take a closer look at the historical P/E, NIKE is trading at its 3-year +1.5STD at 40x (TTM). Of course, judging from the P/E alone would make NIKE an expensive stock. But does it mean that NIKE no longer has an upside? Therefore, we are trying to answer this question: is NIKE still a buy despite trading at a premium?

Sources: Vektor Research, Yahoo Finance

Sources: Vektor Research, Yahoo Finance

Sources: Company, Vektor Research, Yahoo Finance

Sources: Company, Vektor Research, Yahoo Finance

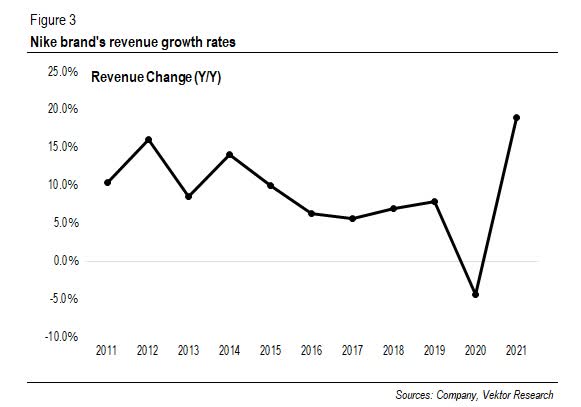

On average, after standing at double-digit in the first half of the last decade, NIKE’s revenue growth rates slowed down to mid-single-digit, as seen in Figure 3.

Sources: Company, Vektor Research

Sources: Company, Vektor Research

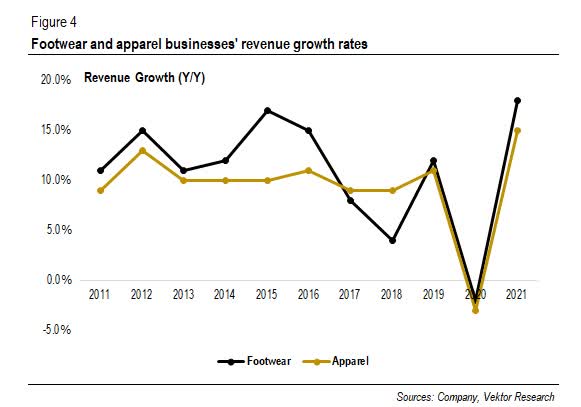

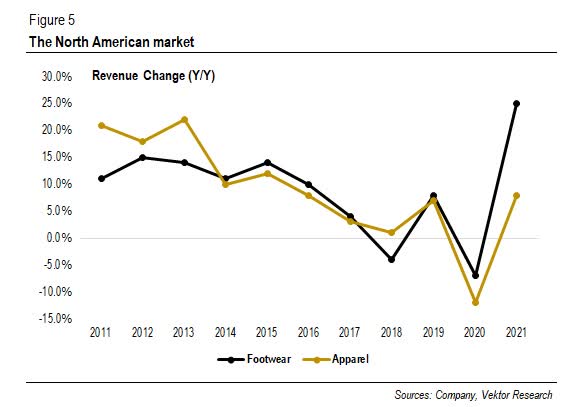

Excluding currency effects, both footwear and apparel businesses have been performing well enough that they produced double-digit growth rates in the first half of the last decade. But in the second half, footwear’s revenue growth rates slowed down New Drop Jordans and eventually nosedived to 4% in 2018. Thus, despite a rather satisfying result in 2019, we wonder whether NIKE will experience another growth slow-down in the future. To answer the question, we will see why NIKE’s revenue growth rates decelerated in the first place.

Sources: Company, Vektor Research

Sources: Company, Vektor Research

Of about US$40 billion of NIKE Brand revenue, 40% stems from the North American market.

Sources: Company, Vektor Research

Sources: Company, Vektor Research

First, in early 2015, West Coast port congestion resulted in increased inventory levels and reduced 3Q15 revenue growth (NIKE ended its 3Q15 fiscal year on February 28th), said Donald Blair, then CFO of NIKE, as cited in JOC.com. Additionally, Trevor Edwards, then NIKE Brand’s CEO, also mentioned the liquidation of factory stores, which impacted the “revenue growth at the store level,” said Andrew Campion, former CFO of NIKE (now the COO).

But the headwinds did not stop there. Mr. Campion mentioned in 2017 that the retail landscape in North America “is not in a steady state,” as “digital disruption” encouraged aggressive promotional activity. In addition, customers’ preferences shifted to “digital and more personal brand experiences,” as cited in the 1Q18 earnings call transcript.

The Optimism Remains

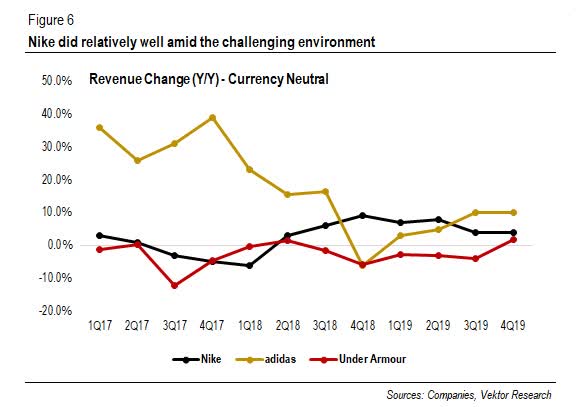

However, the management remained optimistic towards North American’s long-term upside. Despite all the hurdles the management mentioned, NIKE did well in Cadysneaker the North American market compared with other brands (we adjusted NIKE’s figures to the usual fiscal year ending on December 31st only just for the sake of this comparison pictured in Figure 6).

Sources: Companies, Vektor Research

After being hard hit by the pandemic, NIKE recorded jaw-dropping revenue growth of 141% (Y/Y) in 4Q21 in the North American market. The last quarter’s figure looks healthy at 15% (Y/Y), fueled by “back-to-school” and “return to sport,” as cited in the previous quarter’s earnings call transcript. Additionally, NIKE’s efforts to develop its digital presence bore fruit. The company said that the digital business in the North American market led the pack with 40% of currency-neutral growth vs. overall’s 25% in 1Q22.

In other words, we believe that the challenges, which slowed down NIKE’s revenues in the past, were short-lived. Therefore, it is safe to assume NIKE will continue its dominance as the market leader. But is that the case?

Confident In Long-term Prospects

During the 4Q21 earnings call, John Donahoe, the CEO of NIKE, said that “the return to sport,” consumers’ “permanent shift” toward digital, and “health and wellness” are the long-term tailwinds to drive NIKE’s growth in the future. Furthermore, through NIKE’s Financial Outlook, NIKE unveiled the company’s growth prospects and revealed the growth expectations on each market during the 4Q21 earnings call. Moreover, the company expects its 2021Shoes revenue growth to reach high single-digit to low double-digit figures by 2025. The figures reflect the company’s optimism, in our view.

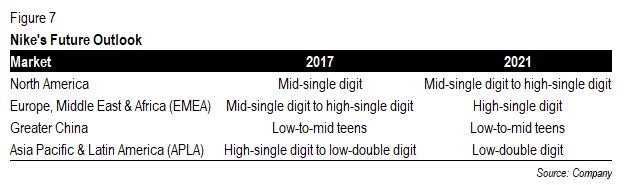

During the Investor Day in 2017, the management also specified the growth prospects on each market, as cited in the 2Q18 earnings call; but the figures were somewhat in a wide range. Now, the company seems to be more confident than before (see Figure 7). For example, NIKE reiterated its EMEA and APLA’s growth prospects on the higher end of the spectrum.

Source: Company

Source: Company

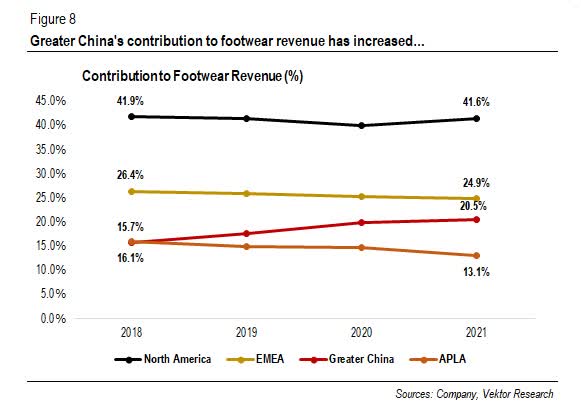

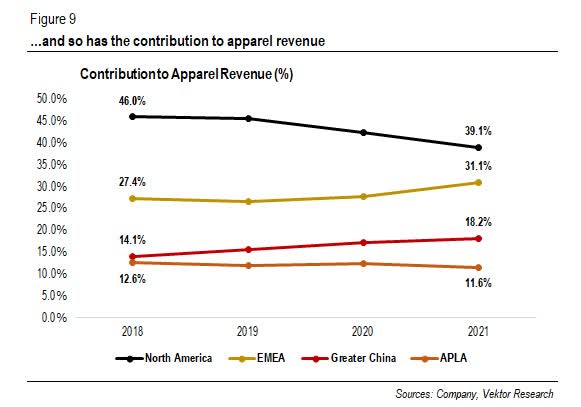

And such optimism is grounded. Figures 8 and 9 show how each market’s contribution to revenues has changed over time. The most significant improvement stems from Greater China, which recorded a 3-year CAGR of 17.3%-far exceeding the other markets.

Sources: Company, Vektor Research

First, let us look at Greater China. The recent Xinjiang cotton issue has indeed put NIKE in a jittery position. According to Bloomberg, domestic players in China, such as ANTA (OTCPK:ANPDY) and Li Ning (OTCPK:LNNGF), gained market share because the Chinese moved from Western brands. But the foreign brands are back on terms.

As cited in SGB Media Online, Citi’s survey conducted in September shows that the appetite for Western brands seems to be recovering. Of 1,000 Chinese respondents, 81% of them said they planned to buy NIKE, a staggering improvement from 48% in June. In addition, the figure increased to 49% from 31% for adidas. On the other hand, for Li Ning and Peak, domestic brands, the figure nosedived to 4% and 7%, respectively, from 54% in June.

Indeed, domestic players are entering the industry. But NIKE’s position as a market leader (Source: Statista) is likely to remain entrenched. Thus, looking forward, we believe that NIKE will continue its dominance in the Chinese market, which will remain the growth driver for the company.

But what is the outlook for EMEA, the second biggest contributor to revenue, about which NIKE expressed its optimism? First, looking at the contribution to the income, we see that the apparel business thrived in the EMEA market. For instance, the popularity of the NBA is getting prevalent in Europe. According to Matt Brabants, 2021 Yeezy Boost the NBA’s senior vice president of global content and media distribution, European players, such as NBA Champion Giannis Antetokounmpo, All-Star Luka Doncic, and MVP Nikola Jokic, have sparked the amount of viewership in the United Kingdom (+72%), Italy (+32%), and Spain (+17%), as cited in Reuters.

Indeed, it makes sense to infer that the increasing popularity of the NBA, sponsored by NIKE, has led to successes in the region. Moreover, the Beaverton, Oregon-based company has instilled its presence in the football industry, investing in some of the biggest football clubs in the world, as we discussed in our article titled “adidas: 3 Essential Points to Consider Before Buying.” Therefore, looking forward, we believe that the EMEA market, alongside Greater China, will be NIKE’s growth driver.

What About The Factory Closure?

Fears have spread among investors following the factory closure in Vietnam. Mr. Donahoe said that the local government forced NIKE to close down about 80% of its factories in southern Vietnam, which cut down a 10-week worth of production, as cited in JOC.com. To mitigate, NIKE is temporarily increasing its production in other countries, such as China or Indonesia, and utilizing air freight.

Perhaps no one plays down the severity of the factory closure impact on the sporting goods companies. However, we have heard a similar story beforehand. For example, like the factory closure, West Coast port congestion, too, led to a supply-demand imbalance and slower revenue growth. But the impact was short-term. As a result, we believe that the current headwinds would not hurt NIKE’s upside in the long run.

So, what is our estimate on NIKE’s top line this year? Assuming that ten weeks of production leads to a loss of half quarter worth of demand, we estimate NIKE’s revenue to grow around 4%, in line with the company’s revised guidance of mid-single-digit revenue growth from low double-digit growth, as cited in CNBC. Next year, as the headwinds subside, we expect NIKE’s revenue to grow around 9.5% (Y/Y).

Valuation

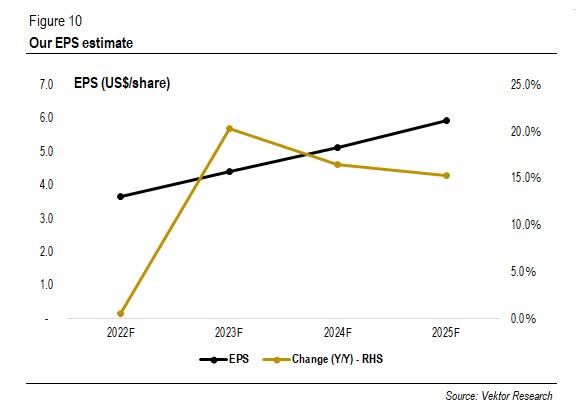

So, the big question is: should we still buy NIKE? Following NIKE’s FY25 target of mid to high teens EPS growth, we estimate NIKE’s EPS to reach US$5.9/share by 2025 (4-year CAGR of 13%), dragged down by possible tepid result this fiscal year. Please note that we use the lower end of the management guidance to minimize over-bullish expectations. For example, NIKE estimates revenue growth to reach high single-digit to low double-digit by 2025. In this case, we forecast revenue growth to reach 7.9% (high single-digit) instead of 10-13% (low double-digit).

For margins, while NIKE’s gross profit margin New Release Yeezy will benefit from full price realization, increasing logistics costs related to supply chain concerns is likely to slow down margin expansion. However, we are still confident that NIKE can achieve its gross profit target of the high 40s and EBIT margins target of high teens by 2025.

If we use the 3-year +1STD and +2STD P/E at 35x and 42x, respectively, the target price will be US$208/share (37% upside) and US$251/share (65% upside).

Source: Vektor Research

For some, buying a premium stock is not a wise choice. But we could make an exception for NIKE. As a market leader, NIKE has something to offer in the long run. In North America, NIKE gains benefits from implementing its digital business, which has recently driven sales. In addition, NIKE is expanding its presence in the EMEA market in both the basketball and football industries. In China, consumers are likely to return to Western brands following the short-term headwind.

The factory closure in Vietnam indeed causes a headache, but the headwind should be short-term. Moreover, the factory closure resulted in stocks dipping, which could present an opportunity for investors to buy at a lower price, in our view.

So, is NIKE a buy? We believe it is relative to your investment strategy. As we described earlier in the article, short-term headwinds could put pressure on the stock price. But long-term, there is evidence to suggest that NIKE is likely to continue its dominance in the future. So, if you are willing to hold a stock long-term, with a potential upside of 37%-65% according to our FY25 EPS forecast, NIKE may be something worth considering for your portfolio. If you have any thoughts, please do not hesitate to comment below.

This article was written by Vektor Research